Gold Leaf Cigarette Price Expected to Hit Rs800 in Pakistan: By the end of next month, the price of a Gold Leaf cigarette in Pakistan is anticipated to reach Rs. 800 as the Federal Government attempts to extract as much money as possible from the tobacco business by implementing higher taxes.

Gold Leaf Cigarette Price Expected to Hit Rs800 in Pakistan

According to some reports, the rising Federal Excise Duty (FED) and General Sales Tax (GST) on tobacco goods will likely cause the price of Gold Leaf cigarettes in Pakistan to reach Rs. 800 by the first of March 2023.

A startling 250% increase in price would result from the government’s recent implementation of a rate of 153% Federal Excise Duty (FED) and 25% General Sales Tax (GST) on the sale of cigarettes in Pakistan.

According to the Federal Board of Revenue (FBR), the FED has climbed from Rs. 6.5 to Rs. 16.5, or a 153% increase, for premium cigarette brands, while it has grown by 98% from Rs. 2.55 to Rs. 5.05 FED per cigarette for less expensive brands.

Gold Flake Cigarette Price in Pakistan

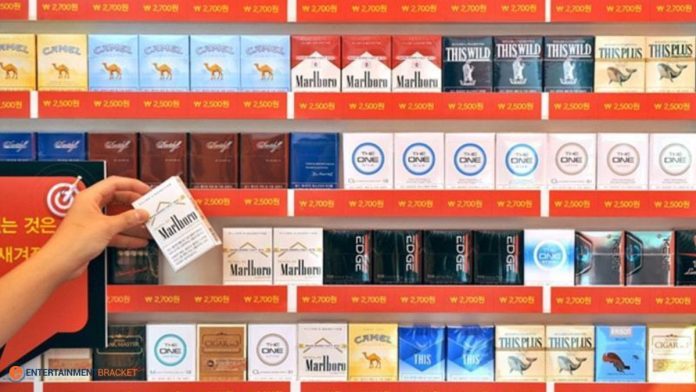

Gold Leaf Cigarette Price in Pakistan

Currently, a pack of Gold Leaf cigarettes costs Rs. 520 in Pakistan; however, the imposition of additional taxes and charges on the tobacco sector will likely cause that price to increase even more by the first of March 2023.

By the end of the following month, the cost of a pack of Gold Leaf cigarettes in Pakistan will reportedly reach Rs. 800. But other brands of cigarettes will experience similar price increases. They will not be the only ones impacted by the higher taxes.

Impact of Increased Taxes

Moreover, Philip Morris Pakistan Ltd., an international tobacco company in Pakistan, has cautioned. The government of the detrimental effect of the increased FED on cigarettes in the nation as it will promote the black market.

The corporation claims that the increased Rate will hurt the economy since it will decrease government revenue. The representative claimed that the tax increase on tobacco businesses would benefit Pakistan’s already sizable black market for cigarettes. He continued, “As a result, there will be a shortfall in government revenue. As company moves from the tax-paid sector to the non-tax-paid sector.”